More than one in four CFOs said they plan to diversify their deposits across more banks after recent high-profile bank failures, according to Gartner, Inc. Gartner polled over 250 CFOs and senior finance leaders on March 13, 2023 on their responses to recent bank failures and financial sector instability.

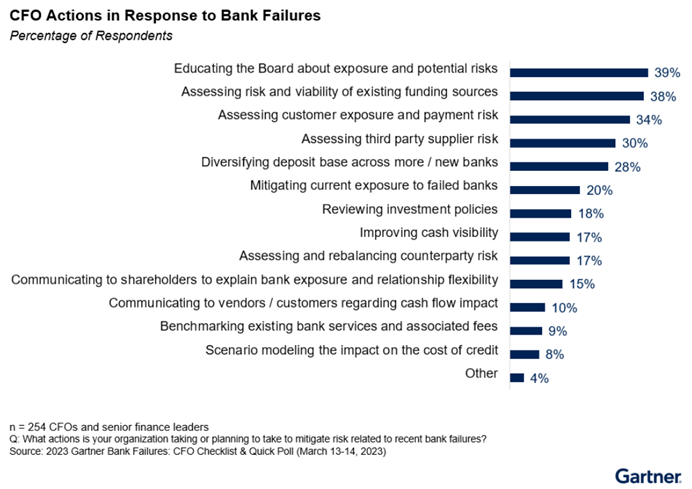

The top actions among CFOs following the failures include educating their boards on current risk exposures and assessing the risk and viability of current funding sources.

“The data shows that CFOs are clearly concerned about second and third-order effects from this unfolding banking crisis,” said Alexander Bant, chief of research, in the Gartner Finance practice. “While the immediate risks may have been stemmed by swift government action, CFOs are rightly assessing potential impacts to their own funding and that of their customers and suppliers. About one-third of CFOs are taking immediate action to reduce risk and ensure the viability of financing their organizations. CFOs have a short window to ensure security of their assets, payments, and funding in case things deteriorate further across the banking sector.”

Eighty-five percent of CFOs expressed concern about the impact of bank failures on their current operations, while 18% noted they had some level of exposure to one of the failing banks. The top actions CFOs are taking, or planning to take, include assessing their own funding sources for risk, educating the board on potential exposures and evaluating customer exposure and payment risks (see Figure 1).